[ad_1]

Shares of PC Jeweler were stuck in a 5 per cent upper circuit at Rs 177.95, also its multi-year high on the BSE, during Monday’s intraday trade amid heavy volumes. The stock rally came ahead of a board meeting scheduled for today to consider a proposed split of the company’s stock.

Till 12:19 pm, a total of 7.57 million shares had changed hands and buy orders were pending for 2.9 million shares on the NSE and BSE. In comparison, the BSE Sensex was down 1.1 per cent at 84,625.

“A meeting of the board of directors of the company will be held on Monday, September 30, 2024, inter alia, to consider and approve the modification of the share capital of the company by sub-division/split of the existing shares having face value of Rs 10 each, entirely released, as may be determined by the Board of Directors,” PC Jeweler said in an exchange filing.

Most companies opt for a stock split after a sharp rise in their stock price, with a view to improving the liquidity of the company’s shares and encouraging the participation of retail investors by making the shares of the company more affordable business.

Shares of small-cap jewelry company PC Jeweler are trading higher for the sixth consecutive trading day, after jumping 28 percent during the period. It is trading at its highest level since May 2018. It had reached an all-time high of Rs 600.65 on January 16, 2018.

An upward movement in PC Jeweler’s share price came after the Bank of India approved the One Time Settlement (OTS) proposal submitted by the company on September 26, 2024.

So far in September, the stock is up 60 percent. In three months, it has soared 249 per cent, while in the last one year, it has soared 577 per cent from the level of Rs 26.30 on the BSE.

In an exchange filing, PC Jeweler said it has opted for OTS to settle its outstanding dues. The terms and conditions of the OTS include cash and equity elements payable under settlement, release of securities and mortgaged properties, etc.

“With this approval, the fourteen member banks of the consortium have approved the OTS proposal previously submitted by the company,” it adds.

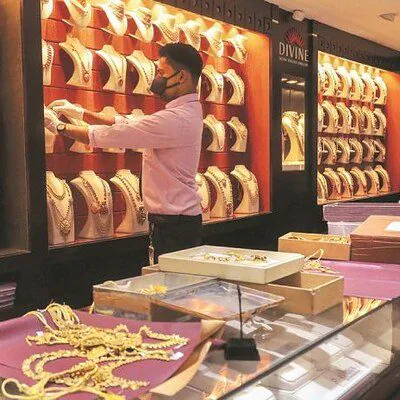

PC Jeweler is one of the leading jewelry companies in the organized jewelry retail sector in India. It is engaged in the trading, manufacturing and sale of gold, diamonds, precious stones, gold and diamond studded jewelry as well as silver articles. As on March 31, 2024, the Company had a total of 60 showrooms, including six franchise showrooms, besides four manufacturing units in India covering 12 States and three Union Territories.

The company has launched a number of jewelry collections over the years. Some of its major jewelry collections are Anant, Dashavatar, Bandhan, Amour, Wedding Collection, Animal Collection, Folia Amoris, The Fluttering Beauty, Mens Collection and Hand Mangalsutra among others.

During the financial year 2021-22, the company’s lenders classified its accounts as non-performing assets, which was challenged by PC Jeweler before various legal forums and the matter is currently sub-judice.

Subsequently, the company and its lenders were involved in various litigations, PC Jeweler said in its FY24 annual report. It added that it had also taken proactive steps to resolve legal matters by contacting its lenders regarding the issue of unpaid debts, with a One Time Settlement Proposal (OTS).

Considering the above-mentioned positive developments, the company has once again started focusing on increasing its brand presence and has started its marketing initiatives in this direction.

The size of the Indian jewelry retail sector in FY23 was close to $70 billion. In this landscape, organized retail accounted for around 37 percent, encompassing both national and regional players. Projections indicate that the jewelry retail market, poised for growth, is expected to reach around $145 billion by FY28.

This optimistic outlook is attributed to the expanding economy, increasing disposable income, strong consumer demand for gold, upward trajectory of gold prices and growing interest in other categories such as diamonds, other precious stones and costume jewelry, PC Jeweler said.

The domestic jewelry industry is expected to register moderate volume growth in FY25 due to a sharp rise in gold prices in recent months, changing macroeconomic scenario and the likelihood of high price volatility.

Branded jewelry retailers, however, are expected to report healthy revenue growth of 20-22 per cent on an annual basis in FY25, with volume growth forecast at around 5 per cent year-on-year (on a year, driven by aggressive store additions, changing consumer preferences, continued rise in gold prices and continued demand for weddings and parties due to Indians’ strong cultural affinity for gold , the company said.

First publication: September 30, 2024 | 1:25 p.m. STI