[ad_1]

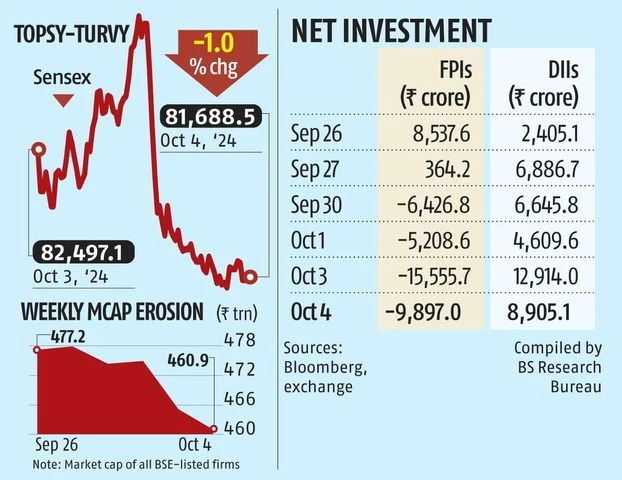

Indian benchmark indices fell nearly one percent on Friday in a topsy-turvy session, capping their worst weekly performance in more than two years.

The worsening conflict in West Asia has prompted global investors to take risks and increased the risk of higher oil prices.

Click here to join us on WhatsApp

Markets have also been under pressure due to concerns over the withdrawal of foreign portfolio investors (FPIs) from India to invest in China, where valuations are attractive.

The Sensex and Nifty fell around 4.5% for the week – the biggest fall since June 2022.

Falling for a fifth consecutive session, the Sensex fell 1 per cent, or 809 points, to settle at 81,689.

The Nifty also fell 0.9 percent, or 236 points, to end at 25,015. Both indices fell more than 2 percent from the day’s highs.

The total market capitalization (mcap) of BSE-listed companies fell by Rs 4.2 trillion to Rs 461 trillion.

This week’s rout has reduced India’s mcap by more than Rs 16 trillion.

India’s VIX, a gauge of market volatility, rose 7.3 percent to 14.1.

)

Meanwhile, Hong Kong’s Hang Seng rose 10.2 percent and the Shanghai Composite Index jumped 8.1 percent this week, supported by aggressive stimulus measures taken by the central government to boost its economy.

Growing tensions between Israel and Iran have investors worried about its impact on crude oil prices.

Crude oil imports account for a significant portion of India’s import bills.

Tensions between Israel and Iran’s proxies in Lebanon, Gaza and Yemen have been simmering for some time, but Iran’s direct missile attack on Israel this week has fueled fears that tensions could escalate into a real conflict.

Some estimates suggest that if Israel were to launch a serious offensive against Iranian oil facilities, it would remove 1.5 million barrels of daily supplies from the market.

Investors also fear that if such an event occurs, Iran could block the Strait of Hormuz, a key maritime trade route through which more than a third of the world’s crude oil supply passes. Brent crude rose 11.6 percent over the past six sessions and was trading at $79.1 per barrel.

)

“Depending on what Israel does, the global fear is that it could target Iran’s oil assets, and if Iran retaliates by blocking major shipping routes, the cumulative effect would be a spiral oil at $100 a barrel This would affect inflation globally, and India would be “India has always been overbought, and now it’s just nervousness due to unfavorable news,” a said Andrew Holland, CEO of Avendus Capital Public Market Alternate Strategies.

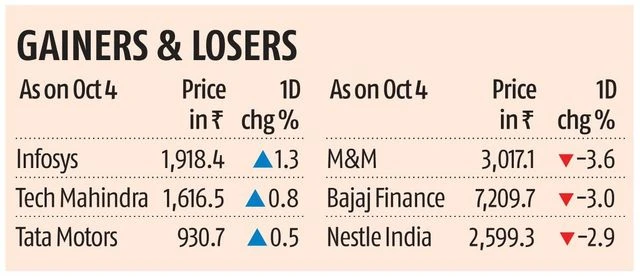

Market breadth was low, with 2,387 stocks falling and 1,563 rising. HDFC Bank, down 1.5 per cent, and Reliance Industries (RIL), down 1.5 per cent, were the major contributors to the Sensex losses. RIL, the country’s most valuable company, has fallen more than 9 percent in the past week.

“Pessimism in the market is likely to persist in the near term amid rising crude prices and fund flows to cheaper markets like China,” said Vinod Nair, head of research at Geojit Financial Services.

FPIs were net sellers of Rs 9,897 crore on Friday, while domestic institutions bought shares worth Rs 8,905 crore.

FPIs were net sellers of stocks worth Rs 37,088 crore this week, and domestic institutions bought stocks worth Rs 33,074 crore. On a five-day rolling basis, REIT sales are the highest in 24 years.

First publication: October 5, 2024 | 00:01 STI