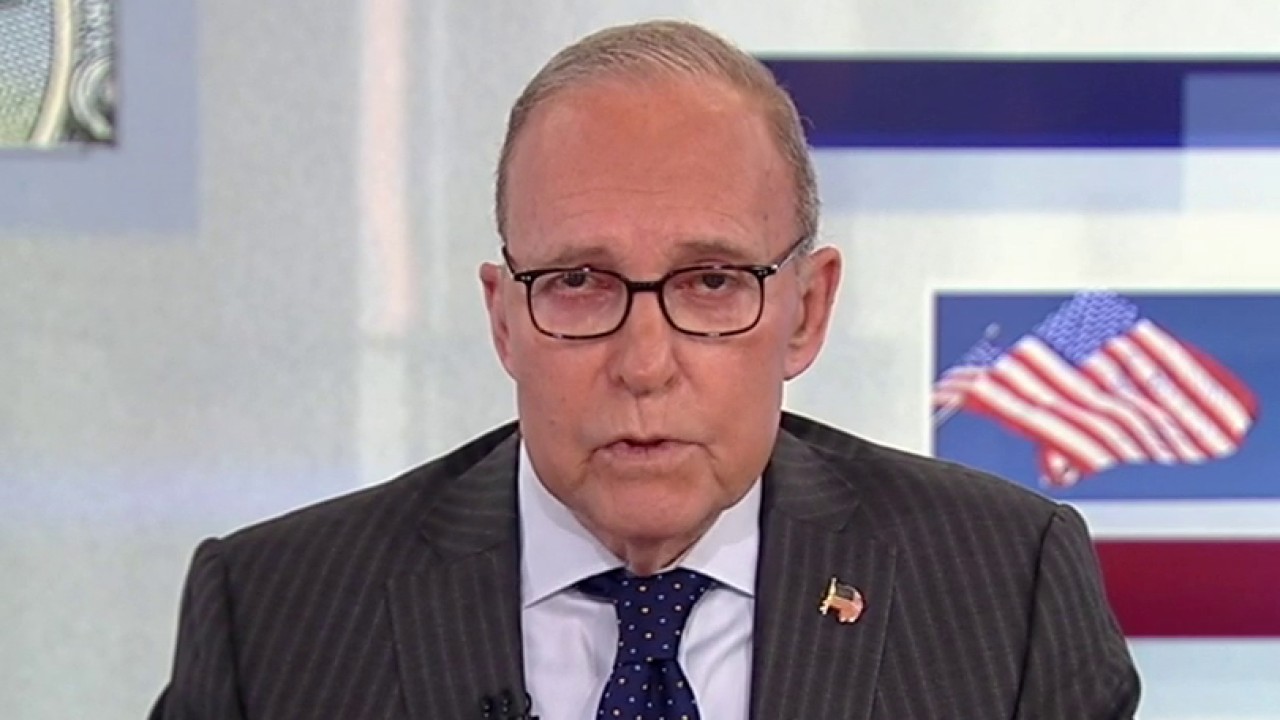

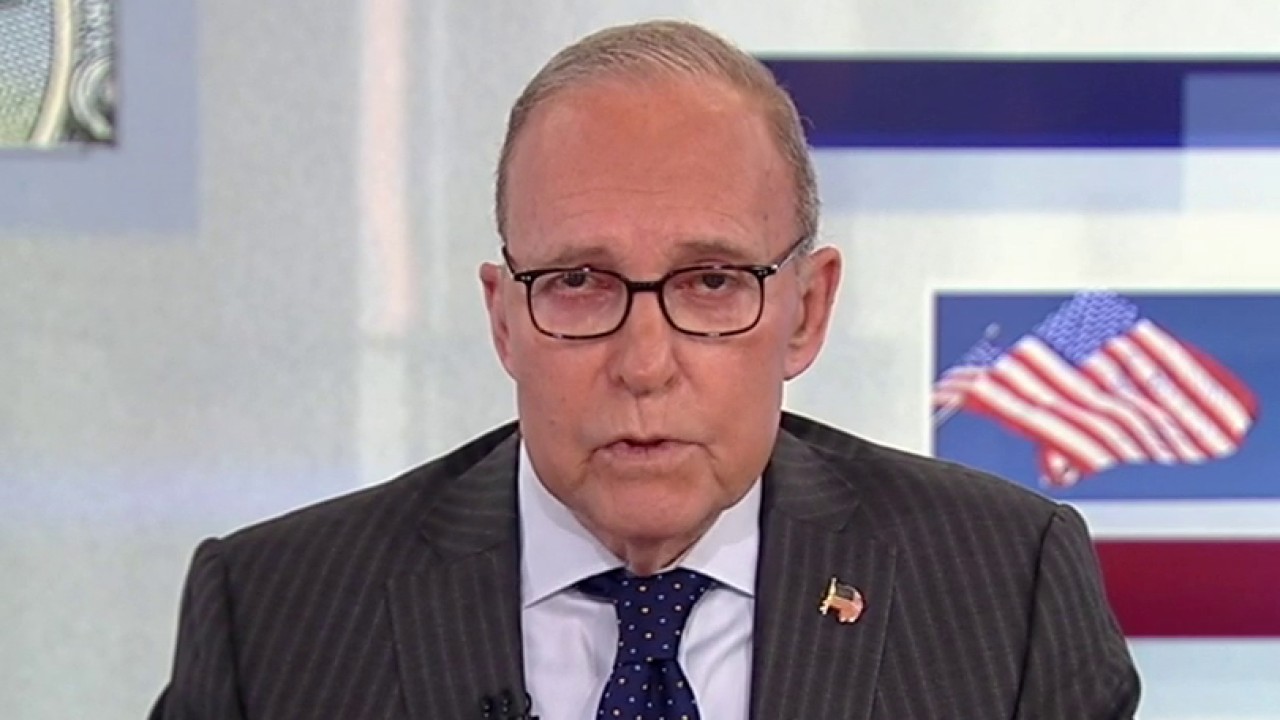

FOX Business host Larry Kudlow explains the Federal Reserve’s response to inflation on “Kudlow.”

The Fed is playing politics and that is the subject of the riff. Almost every new economic figure out of Washington shows how political the Fed’s decision was to implement a massive 50 basis point rate cut in mid-September.

First came the embarrassingly large jobs report – even though its main contributor was in government jobs. Still, it was a big number, and big job numbers don’t usually equate to massive interest rate cuts by the central bank. Then there’s today’s CPI report, which showed persistent inflation. Over the past twelve months, the topline CPI has risen 2.4%, which is 20% higher than the Fed’s 2% target. Under the hood, so-called core inflation was 3.3%, which is 65% above the Fed’s 2% target, and while Kamala Harris‘ campaign criticized J.D. Vance for suggesting that a dozen eggs now cost $4 — because they actually cost just $3.20 in August – which was still more than double what it was during the Trump years.

Meanwhile, Breitbart’s John Carney reports that Vance was actually closer to the target than his critics, because according to the CPI report, eggs are up 10%, up 39.6% in the past year and the average price of eggs at this currently amounts to $3.82. Mr. Carney calls this “Hillbilly Egg-igy.” Ha. Ha. Ha. Mr. Carney: A very good pun, but this all begs the question: why did the Fed launch its extreme rate cut just over six weeks before the election? That’s unheard of during a presidential cycle.

INFLATION RISE BY 2.4% IN SEPTEMBER, ABOVE EXPECTATIONS

Guggenheim’s Anne Walsh discusses the election effects on investing in ‘The Claman Countdown’.

The Fed was being political. Regardless of which side of the aisle you are on, an objective look at the numbers shows that the Fed was political. That Fed head Jay Powell who went out of his way at his last press conference to deny that the central bank would ever play politics, was in fact further clear evidence that the Fed was indeed playing politics.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

There are major weaknesses in the economy, particularly in the manufacturing and housing sectors, both of which are in recession. Consumer spending, aided by large government stimulus measures, is holding back the economy economybut the Fed’s stated reason for their mega rate cut was likely a collapsing job market and the certainty that inflation would reach their target.

Inflation is more persistent, the Fed has missed its 2% target, and the labor market is holding up very well – for whatever reason. So Mr. Powell, in all his wisdom, has done what the Fed is not supposed to do: meddle in the election, try to inject some last-minute juice into the Kamala economy. Literally, right before election day. In the world of monetary policy, Jay Powell just dragged the central bank to a new low. That’s the riff.

This article is adapted from Larry Kudlow’s opening commentary on the October 10, 2024 edition of “Kudlow.”