[ad_1]

By Ruth Carson, Masaki Kondo and Winnie Hsu

Japanese investors are beginning to lose their decades-long enthusiasm for foreign assets.

Click here to join us on WhatsApp

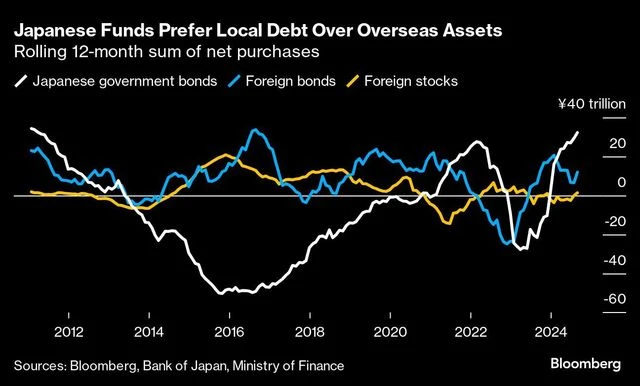

In the first eight months of the year, Japanese investors acquired a net 28 trillion yen ($192 billion) of the country’s government bonds, the largest amount for that period since at under 14 years old. They also cut their purchases of foreign bonds by almost half, to just 7.7 trillion yen, and their purchases of foreign stocks were less than 1 trillion yen.

“This is going to be one of the megatrends and a super cycle for the next five to 10 years,” said Arif Husain, head of fixed income at T. Rowe Price, who has nearly three decades of investing experience. . “There will be a sustained, gradual but massive flow of capital from abroad to Japan. »

With $4.4 trillion invested overseas, more than the Indian economy, the speed and scale of any downturn has the power to disrupt global markets. Although the rate gap between Japan and other countries has narrowed, capital inflows have been a trickle rather than the flood some investors feared.

)

Japanese overseas investments have been likened to a giant carry trade, in which investors benefited from ultra-low interest rates available at home to finance their overseas purchases.

The size of the flows will depend on the pace and trajectory of rates in Japan. While Bank of Japan Governor Kazuo Ueda has indicated that policymakers will be more measured about hike plans, strategists almost unanimously predict a stronger Japanese currency next year, saying that policy will inevitably shift. normalize.

Yields on Japan’s benchmark 30-year government bonds rose about 40 basis points to more than 2% as the BOJ raised rates this year. We are approaching the point where some of the country’s largest insurers intend to increase their holdings of local debt.

T&D Asset Management Co. said a 30-year JGB yield above 2.5% may be a level for money to come home. Dai-ichi Life Insurance Co. said in April that yields above 2% on such bonds would be relatively attractive. The yen weakened 0.4% to 144.16 per dollar on Wednesday.

Japan Post Insurance Co. still invests overseas, but “it has become easier to invest in yen-denominated assets,” said Masahide Komatsu, senior general manager of the company’s global credit investment department. “We want to diversify our investments.”

)

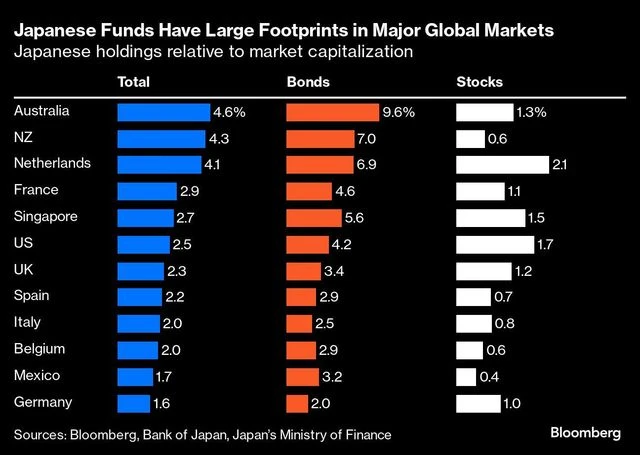

The stakes are enormous: Japanese investors are the largest foreign holders of US government bonds and hold almost 10% of Australian debt. They also control hundreds of billions of dollars of stocks from Singapore to the Netherlands and the United States, holding between 1% and 2% of the markets. Their reach extends to high-risk investments such as cryptocurrencies and risky debt that have boomed in Europe.

They built up assets during the years when interest rates were below zero in their country and acquired everything from Brazilian bonds that yield more than 10 percent, to shares of Alphabet Inc. and lots of risky loans in the United States.

A prominent example of this desire to expand overseas is Norinchukin, Japan’s largest agricultural bank, which has invested a significant portion of its 60 trillion yen securities portfolio in U.S. and European government debt. It is currently liquidating about 10 trillion yen of foreign investments after an unexpected rate hike increased its funding costs and forced it into losses. San-in Godo Bank Ltd., a regional bank based in western Japan, also plans to increase its JGB holdings while selling Treasury bills.

A nightmare scenario for markets would be an even more extreme version of the chaos of August 5, when fears of rising Japanese rates and a slowing U.S. economy led to a rapid unwinding of bets on carry trades by global hedge funds and other foreign speculators. The Nikkei 225 suffered its biggest rout since 1987, Wall Street’s stock volatility gauge soared and the yen advanced. Even gold, a safe haven in times of stress, fell.

Japanese investors – including some of the world’s largest pension funds and insurers – have remained largely dormant, underscoring the potential for further tectonic shifts.

The unrest also prompted the BoJ to say it would take market conditions into account before raising rates again and would refrain if markets were unstable. Additionally, the Federal Reserve cut rates by half a percentage point in September, in an effort to keep the U.S. economy strong.

“August gave us a glimpse of the repatriation trend,” said Charu Chanana, global markets strategist at Saxo Markets. “The Fed’s commitment to a soft landing has reduced the risks of a recession. This means that future repatriation may not be as brutal.

)

Even as policy normalizes, Japanese rates remain hundreds of basis points lower than peers in the U.S. and Europe, meaning offshore assets continue to attract yield-hungry investors willing to tolerate exchange rate risk. The Japanese Government Pension Investment Fund, one of the world’s largest pension funds, targets about half of its holdings in foreign bonds and stocks. These positions helped it offset domestic debt losses during the last reporting period.

Japanese investors “realize that U.S. markets are still incredibly liquid, very large and offer the greatest diversification,” said Anders Persson, global head of fixed income at Nuveen LLC. “They’re looking for opportunities that are a little more productive.”

After market chaos in August, JPMorgan Chase & Co. estimated that up to three-quarters of carry trades had been unwound. This analysis focused on global trade financed by borrowing in low-rate currencies. With a BOJ benchmark rate of 0.25%, the yen still meets these criteria. As this changes, Japanese people will have more and more incentive to bring their money home.

“Across the world, investors are underestimating the risk of large long-term repatriation flows,” said Shoki Omori, chief strategist at Mizuho Securities Co. in Tokyo. “The Japanese are great carry traders themselves. The trend is already underway – watch this space.

(Updates with yen in 8th paragraph)

First publication: October 2, 2024 | 11:20 p.m. STI