[ad_1]

)

Illustration: Binay Sinha

FTSE Russell said on Wednesday it would add India to its emerging markets government bond index from September 2025.

FTSE Russell is the third index provider to include Indian bonds in its emerging markets bond index after JPMorgan and Bloomberg Index Services.

Click here to join us on WhatsApp

According to the FTSE, Indian bonds will constitute 9.35 per cent of the index on a market value weighting basis, making it the second largest component after China.

Bond market participants said the inclusion will not have an immediate effect on the market given that the official inclusion date is still far away.

“It will have no impact because it is too little and too far,” said Vikas Goel, managing director and chief executive officer of PNB Gilts.

This follows the inclusion of local bonds in JP Morgan and Bloomberg Index Services, which could lead to significant inflows into the Indian government bond market.

In September 2023, JP Morgan announced the inclusion of Indian bonds in the JPMorgan Government Bond Index-Emerging Markets (GBI-EM).

On March 5, Bloomberg Index Services revealed that Indian government bonds would be added to its Emerging Markets Local Currency Government Index from January 31, 2025.

)

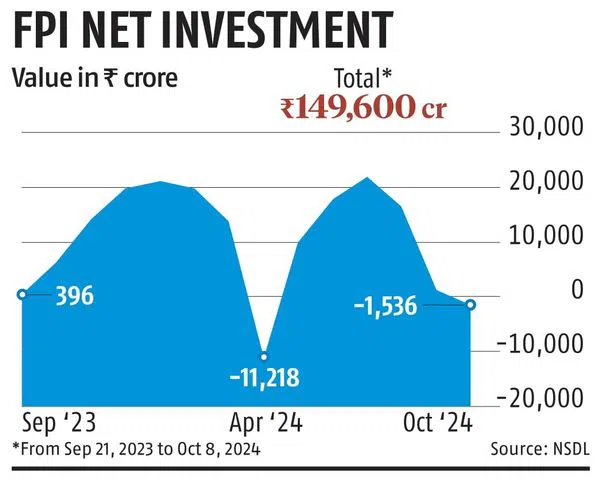

Since JP Morgan’s announcement on September 21, 2023, the Indian debt market has recorded net inflows totaling Rs 1.49 trillion.

The process of inclusion in the JP Morgan bond index will take place over a period of 10 months; with a weightage of 1 percent included every month until March 31, 2025. Indian bonds will have a weightage of 10 percent, like that of China.

Since the official inclusion on June 28 of the current year, the debt market has recorded net inflows worth Rs 2,234. A net total of Rs 62,974 crore has been injected into designated government securities under the Fully Accessible Route (FAR) during the same period, according to data from the Clearing Corporation of India (CCIL).

Indian stocks will be included in the FTSE’s EMGBI after spending the last three years on the index provider’s watch list. According to the October 2024 index profiles, 32 Government of India FAR bonds, denominated in INR and with a combined outstanding face value of $473.8 billion, are expected to be eligible for inclusion in the EMGBI.

Meanwhile, the yield on the benchmark 10-year government bond fell in early trading after FTSE Russell said it would include Indian bonds in its indices.

Yields fell further to 6.74 percent during the day, before stabilizing at 6.77 percent, after the national rate-setting committee decided to change the position to neutral. The benchmark yield had stabilized at 6.81 percent on Tuesday.

Market participants said yields rose slightly at the end of the trade as the market sensed the hawkish tone of the policy. However, the benchmark yield is expected to moderate by the end of the current financial year once the RBI initiates a rate cut.

“The 10-year yield was trading lower at 6.75 percent after the policy was implemented. We expect the 10-year yield to trade in a range of 6.7 percent to 6.8 percent in the near term and decline to 6.6 percent to 6.7 percent in the near term. here the end of this financial year with the start of the RBI’s rate reduction cycle. and a moderation in US yields (amid Fed rate cuts – 50 basis point cut expected for remainder of 2024 and 5-6 rate cuts expected in 2025),” HDFC Bank said in a note.

The London-based index provider also revealed that South Korean government bonds would be added to the FTSE World Government Bond Index. These bonds constitute 2.22 percent of the index on a market value basis, with inclusion from November 2025.

First publication: October 9, 2024 | 7:25 p.m. STI